tv The Exchange CNBC April 24, 2024 1:00pm-2:00pm EDT

1:00 pm

the corner >> goldman sachs, i still think there's more upside ahead. soz we're still in the red across the board, but we'll have an interesting finish as we take you up to that meta release and tell you what to watch for you'll hear from shareholders, as well. "the exchange" is now. see you at 3:00. ♪ ♪ we'll be there with you, scott. thank you very much. welcome to "the exchange," folks. i'm tyler mathisen in today for kelly evans. here's what we have on the docket the bull market has room to run, and the recent volatility has presented great opportunity. that is according to one of our guests today he's here with what makes him so optimistic and the three names he likes right now boeing's loss may have been smaller than expected, but it was an ugly quarter. we have the latest on earnings and how quality control issues are being handled at that big

1:01 pm

manufacturer three more names on board to report, including meta we have the story, the action, the trade into the print but we begin with dom chu with the numbers. >> ty, today's bull run, at least today's bull run, trying to build on the last couple of days, is losing steam throughout the course of the late morning into the early afternoon session. the s&p 500 is down one twaur -- quarter of 1%. so down 12, but at the highs earlier today, we were up roughly 19 points and down 23 at the lows of the session. so we've been kind of losing a little bit of steam throughout the course of the day. the dow down about 1/3 of 1%, 117 points to the downside 38,384 the nasdaq composite just about flat so outperforming so far, only down about ten points. again, it was solidly higher earlier in the session the come poise it index at 15,686 some of the headliners today include some big upside movers

1:02 pm

on the travel and leisure side, hilton up about 4.5% right now a good quarter for them, better than expected earnings and revenues they razed their guidance, so hilton worldwide up 4.5% so another one to watch is the single best performer in the s&p 500. it's all about fun and games hasbro shares up about 10% or so a beat for profits and revenues, so hasbro thanks in part to better inventory management, better digital game sales. this is the parent company of g.i. joe, dungeons and dragons the second biggest stock in the s&p 500, probably the bigger influence, tesla shares up about 10% right now. $159 and change per share. it missed results on profits and revenues, but a lot of optimism about the possibility of a more affordable vehicle model coming at the later part of this year or early 2025. tesla shares a big focus here.

1:03 pm

back over to you >> dom, thank you very much. sit a big week for the economy, with pce on friday, the gdp tomorrow, and critical to that gdp report will be a number that isn't even part of that report, it's the productivity number that has ignited a debate about whether or not the data signal a boom or a blip and steve liesman has the latest on that. a debate with the fed and economists you've got to love to see the fur fly. >> well, there are members of each side within each group, right? you have the fed folks who are optimists and pessimists and some economists, as well the growth in productivity is the biggest part in how the economy grows, and whether we're seeing a post pandemic noise in the data, or is it a real boom here's the data for the five years before the pandemic. productivity grew at a trend like 4.4%. through the first quarter of

1:04 pm

last year, it dropped to 1.3, followed by a really worrying decline. but it's come back the past three quarters have seen an off the chart number average of 3.7% chicago fed president austan goolsbee laid out how critical it is for the fed to get this right. >> that's fundamentally going to change everything about the economy, in a way. and it would have direct implications for monetary policy it would put us back in an environment that would very much be like the late '90s, where you could have faster wage growth without inflation, you could have faster gdp growth >> but there are skeptics who say this is post pandemic noise in the data. that you have work from home, but the hours are mismeasured, and it's too soon to tell, because productivity is best measured over scales like five or ten years the optimists say work from home

1:05 pm

could be a source of greater efficiency with better matching productive employees with jobs companies learning to do more with less from the pandemic, and higher growth and inflation, forcing them to higher productivity measures. jay powell has been in the camp of skeptical, but on "squawkbox" this morning, jason fuhrman summed up the middle ground. >> what we're seeing in the data is just noise and post pandemic gyration what we're seeing when we read about what's happening in ai, the developments and companies, and the developments of the technology, i think that's real, just not in the data yet >> for the fed, it means higher productivity could mean lower for longer it's like adding factories and workers without adding either. getting there could mean more for capital, so short-term that could mean higher rates until the productivity takes hold.

1:06 pm

>> i love when economists talk about gyrations. it gets me going let me ask you, just from a dumb point of view, what is productivity, how do you measure it, and what influences it or changes it for better or worse >> it's efficiency output hour for hour in a service sector economy, it's very difficult to measure >> i don't know how you would measure my productivity. >> say you were a journalist oh, i think that's a real example. let's say you used to write stories a week, and then somebody gave you a computer remember, you probably used to use the carbon painer? >> oh, yeah. >> say you increased that to ten stories a week let's say there was no change in accuracy, which is a measure of your output and you got paid the same number of that. that would be an increase in productivity so there are more stories there for the same amount of inputs, while of course you have to

1:07 pm

measure the capital input, as well >> is improved productivity largely driven by technological advancement like better computers, like ai, like using data -- >> i would like to answer that question yes, but it's not 100% true technology is a big part of it but business process is another part of it say you figure out a way to gather information, or say you find a better source for your story that add -- has the information more quickly that's not technology, that's business process and then there's another thing it's called tfp, or total factor productivity, okay get ready for this this is what economists call man manna from heaven. say you measured all the capital and labor you put in and you still have more productivity on top of that, it's the added value, tfp that's the good stuff. that's the stuff we're really

1:08 pm

looking for, where it's not just dollar for dollar, increase in productivity -- >> it's not just throwing more capital or people, it is -- >> added value productivity that happens from changes that have been made. now, that's the thing the economists really look for it's also the hardest thing to measure, because it's really -- you've got to account for all the other inputs into it it's what's left over after you think you have accounted for everything look, tyler, we grow 1.5% productivity a year. that's normal base rate. the debate we're having now, has that number ratcheted up it's almost certainly not 3.7. that would be crazy. say you have a printer, and that printer puts out 100 pages a minute and then you get the next generation printer goes 101.5 pages a pinminute, that's norma productivity but the next printer puts out

1:09 pm

150 pages. that's a kwantive step in productivity growth. >> steve, thank you very much. now five-year notes, they are up for auction and rick santelli has the action. rick >> yes, tyler. and i'm talking at the intraday chart of 5s. we're starting to see rates creep up a bit the auction, the grade for demand is straight up 1:00 eastern by investors, my grade was a c. straight average across the board. let's go through it. $70 billion, record offering of five-year notes by the u.s. treasury came in at a yield of 4.659, about a half a basis point above the one issued market. higher yield, lower price, and the seller on the government side but that really accounted for some of the mark but all the other metrics pretty much were on top of ten auction average. some were a little below, some a little above the one that struck out a little above was the direct fitters at

1:10 pm

19.2%, but straight across the board average. if we look at the longer term chart, we could see that over the last couple of weeks, interest rates have ramped up for new high yield closes for the year going back to november. that is an issue that we need to pay close attention to, and break it down versus supply issues, debt servicing issues, and some of the data like we're going to receive friday and how it affects the fed, which affects the market tomorrow will be the last of the supply, with seven-year notes. of course, they're not going to be the record demand -- excuse me, the record supply we've had in 2s and 5s tomorrow's $44 billion is not the largest seven-year, but the package of 2s, 5s, 7s is a record tyler, back to you >> rick, thank you very much 28% of the s&p 500 companies have reported earnings so far. 79% have beat the estimates by an average of 9.4%

1:11 pm

that's good news for the companies, and for my next guest's market thesis. he says earnings are the key catalyst that will keep the bull market going he's a chief market strategist at raymond james matt, welcome. good to have you with us >> great to be back, tyler good to see you. >> yes, you the same let's talk a little about earnings and what's coming up. i guess we have meta, a bunch of other ones later on. anything that you're particularly going to be paying attention to or keying off of? >> tyler, what you said to start this is the key. earnings growth overall for the market, that's going to be the key arbiter of whether this bull market continues or not. so far, earnings are coming in very, very nicely. eps is ahead of expectations, revenues are ahead of expectations so that's all positive obviously, from a sentiment perspective, what we hear from the mega caps coming up, we have

1:12 pm

meta, microsoft, alphabet this week, you have a host of the rest of the mega caps next week. that i think is going to be very important in the short term. but overall, i think what we're seeing is that there's a broad number of companies across sectors and industries that are reporting good numbers, and to me, that supports this idea that we are seeing a broadening out of the market. we're seeing a rotation underneath the surface so whether or not the market is down because yields are moving higher, you have to be looking long-term. to me, i would be using down size opportunistically, because the fundamentals are in place, and there's good opportunities across sectors and industries right now. >> a lot of the folks that we have on our air here, like you, these days are talking about small caps a lot of people have been talking about small caps for a long time. so i guess i'm kind of from missouri, show me. show me the money here when is that going to happen, or is it happening?

1:13 pm

>> yeah, i think -- i feel like small caps are trending into the international trade for the past decade maybe they're going to outperform and we're still waiting to a large degree. i think small caps are not a monolith when you look at the russell 2,000, that's not an index i would recommend any client own on its own, because there's so many companies that don't make money. a key part of my market thesis, tyler, is you have to own quality going forward, companies that have a path to earnings or have free cash flow. that's all really important. when you look beneath the surface at small caps, there's a number of high quality companies that don't have significant leverage, that have strong balance sheets and can expand and are leaned into a lot of the trends, like increasing cap x, bringing reshoring back to the u.s., the artificial intelligence revolution, being powered p ed by data centers that will move small caps, and if we can start to get an

1:14 pm

inflexion point with respect to earnings for small caps, that's what gets the market moving, because it's so underowned by investors right now. i think once you get a little bit of momentum, the flows will beget the flows and you'll see some strong upside >> let me make sure i heard you correctly. did you say to not go with the russell 2,000 because too many of its constituents don't make money and rather go with small-cap companies, maybe individual choices, where the profit picture is better, the balance sheets are better, the debt is lower, did i understand? >> that's exactly right, or go with an active manager actively picking stocks so you can lean into growth and value. but owning the index overall, you have 2,000 companies with questionable quality >> you like small caps and cyclicals, including energy,

1:15 pm

nextera, et cetera explain. >> that's right, tyler cyclicals right now have the opportunity to keep outperforming, and it's a hedge in many ways against inflation right now. so you look at the industrial complex, which is where vertiv fits it crushed earnings this morning. they provide cooling systems and power management to data centers, which we know we need to invest in a lot more of them going forward. so they're a high quality company. they're generating more free cash flow, balance sheet leverage is coming down, so it ticks a lot of my boxes. when you look at nextera, they pay dividend dividend growers have been underappreciated by the market overall for the better part of a year or so when yields do come down, investors are going to see dividend growth, but nextera is the largest renewable provider

1:16 pm

of solar and wind in the world they provided good earnings yesterday, and their backlog is increasing so it hits the higher quality beat, plus you get the dividend component. and energy has been a great trade. energy hedges some of the inflation in geopolitical risks that we're facing right now. so what i tell clients is, it's tough given the gains and some of the energy names to pick one single stock but oilservices have been left behind relative to refiners and some of the exploration and productive names, tyler. so what i would say, buy the lah, because you'll get broad exposure to the servicers. we need to extract more oil from the ground with less cap x and using less balance sheet this is a name that ticks those boxes. >> matt, thank you very much see you again soon >> great to see you. >> thank you very much let's turn to housing right now. new data show just how sensitive buyers are to any movement in

1:17 pm

rates. diana olick has that story >> rates rose for the third straight week last week. the average on the 30-year fixed increased to 7.24%, with loans 20% down as a result, applications to refinance a home loan, which are most sensitive to weekly moves and interest rates, fell 6% for the week they were 3% higher than a year ago. applications for a mortgage to buy a home fell 1% for the week and 15% lower than the same week a year ago, as home prices rise, along with interest rates, potential buyers' purchasing power are suffering a double whammy as off what happens, the adjustable rate of mortgage applications rose to 7.6%. arms can be fixed up to ten years, although they're riskier loans. these numbers were for last week let's look at what's going on today.

1:18 pm

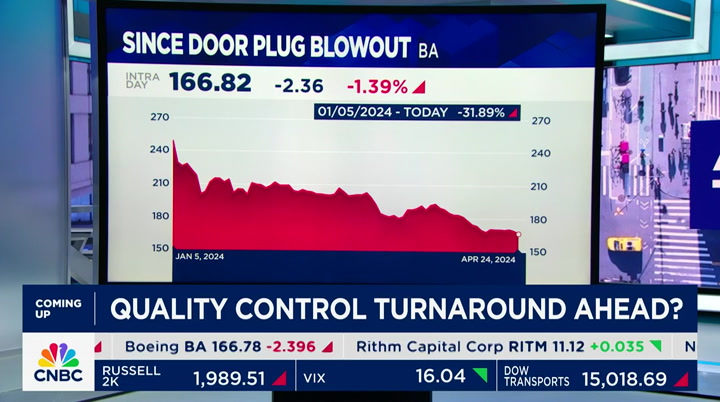

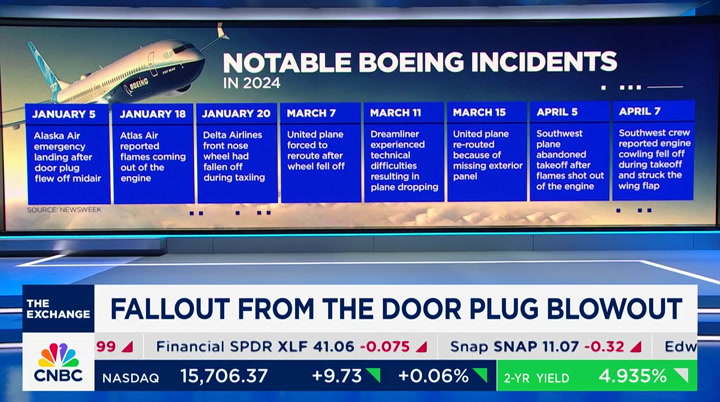

rates dropped a little bit to start this week according to mortgage news daily, but made a tiny tick higher to 7.39%. the next potential big move would be on the monthly employment report at the end of next week, tyler >> diana, thank you very much. the senate, as you probably know, has passed a bill that potentially could ban tiktok in the u.s. we'll look at what's next, what this means for u.s. users, and what will happen to tiktok's algorithm. shares of boeing down 32% since that door plug blowout in january. today's report and words from the outgoing ceo, did it shed any light on a turn around in the company's culture, quality control and its investment potential? harbicorp surging on talks of an ibm takeover up another 9%.

1:19 pm

"the exchange" is back after "the exchange" is back after this ♪(voya)♪ there are some things that work better together. like your workplace benefits and retirement savings. voya helps you choose the right amounts without over or under investing. across all your benefits and savings options. so you can feel confident in your financial choices. they really know how to put two and two together. voya, well planned, well invested, well protected.

1:20 pm

you've got xfinity wifi at home. v take it on the go with xfinity mobile. customers now get exclusive access to wifi speed up to a gig in millions of locations. plus, buy one unlimited line and get one free. that's like getting two unlimited lines for twenty dollars a month each for a year. so, ditch the other guys and switch today. buy one line of unlimited, get one free for a year

1:21 pm

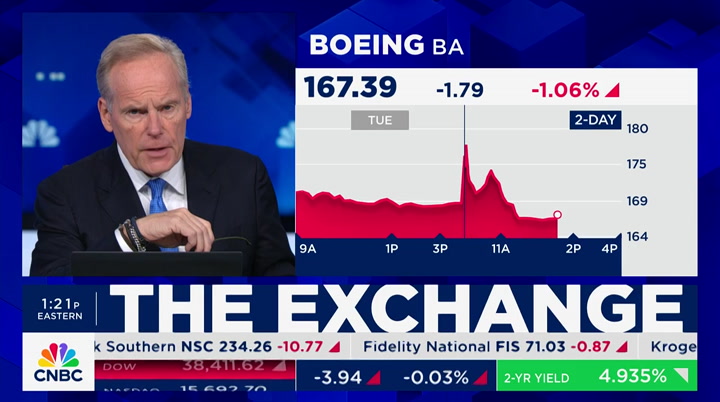

with xfinity mobile! plus, save even more and get an eligible 5g phone on us! visit xfinitymobile.com today. welcome back to "the exchange." boeing posting a smaller than expected loss per share and free cash flow burn, but sentiment still shaky as investors and travelers look for clarity on production and quality control following that door plug blowout in january and other issues. here's what the outgoing ceo dave calhoun said this morning >> the review is going well, in the sense that we're both approaching it business-like we all want the same thing we want a factory under control. we want to set a metrics that

1:22 pm

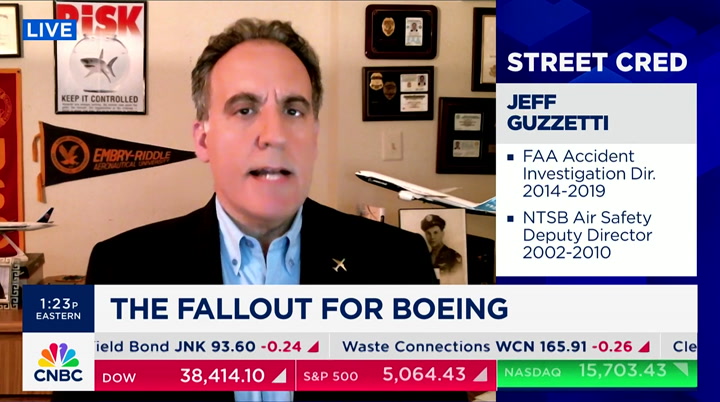

demonstrate it's under control month to month to month to month. and then we want compliance on the floor. are your tools in the right place? are theinstructions set up the way they're supposed to be we want that to be as perfect as it can be. easily measurable, ande eat the end of 90 days, you'll have to demonstrate performance every step of the way. >> but as negative headlines continue, it is unclear if bowing is yet out of the woods let's bring in two experts to shed light joining us now is oscar munoz, former united airlines ceo, and jeff gazetti, a former ntsb investigator gentlemen, thank you very much for being with us. jeff, let me start with you. how do you grade boeing so far in terms of transparency, clarity, and action in

1:23 pm

correcting the production issues that they seemingly are facing >> i tell you, tyler, i have to say it's a b plus. i think they're saying all the right things i think they're trying to be transparent. i would not give them that grade four months ago, but it seems like they have gotten some religion since that plug door blue out january 5th so i think they're saying all the right things and moving forward. >> are they doing the right things from where you sit? >> so that's a tougher nut to crack. mr. calhoun said it right there, that they need to show these tools to the faa and they need to show measurement of meeting those tools on the factory floor, as well as their safety culture and everything else. the jury is still out on the actual implementation. >> mr. munoz, do you derive

1:24 pm

confidence from mr. calhoun and what boeing seems to be doing? i'm sure you have a level of trust, if not devotion to them >> as we all talk, yes, there's a lot of trust and hope that this works itself out for so many different reasons it's a great asset to the united states manufacturing power sit a great source of commercial activity as far as airlines, as well as the state department or the defense department but the progress, as jeff mentioned, is what everybody has been waiting for what are you doing and when are you going to have it done by and so we've seen the management shakeup. we've seen the development of a plan a little bit of proof of the promise, which is important. and the issue will be financially whether they -- those delayed orders, and they have a huge backlog, as you know it all points to something positive that they've got to get past this perception, the media pressure that's on this, and

1:25 pm

with that, they've got to get some really strong communications out there the negative is reported every time something happens with an aircraft >> how much trust have they lost among airline executives and the people who are negotiating contracts, how much trust have they lost, and how do they get it back? >> well, trust is a commodity, and yes, it's been lost. and the way you get it back is you reearn it. you're going to reearn it by delivering what you said you were going to do and in a world of practical capital markets world, it's going to cost you. the demand has been there for a long time and will still be there, but i think they're going to have to, for lack of a better word, give better pricing, better deals to the right people because of all the delay that it's causing it is really been impactful to several airlines around the world about their growth plans these are planes that are built years in advance

1:26 pm

you hire pilots and crew and resources for that to have to shut that down, it's a painful, if not an economic hit to people with growth perhaps. so how do you reearn that trust? it's going the take more than just bringing on a good aircraft it's going to take a lot, and a lot of trust building. >> mr. gazetti, how candid with the flying public can -- or with the investment community, can mr. calhoun truly be is he in any sense restricted in what he can say or from a competitive viewpoint, in what we should say about where boeing is, what it's doing, are they in any way restricted by the ntsb or the faa >> no, tyler they're only restricted in specifically talking about the actual investigation that ntsb may be doing so the ntsb is hot and heavy with the door plug investigation. they're going to have a public

1:27 pm

hearing on it. so anything relate specifically to the door plug incident in january, he cannot talk about. but other than that, he can talk about anything else. how well their reporting program is, how they're building their safety culture you know, i think oscar's right, boeing has a steep hill to climb in terms of communicating what they're trying to do and to improve their safety they just got to keep trying to do that. because they do wantto tell a story, and they can tell that story slas long as it's not specifically related to the door plug accident. >> let me finish with a blunt kind of a cudgel of a question, do you trust boeing and trust flying on boeing airplanes jeff, you go first >> i'll answer the latter one first. i do trust flying on boeing airplanes. i don't have any issue flying on any type of boeing airplane, to include the max. do i trust boeing, period? the jury is still out on that.

1:28 pm

i think they have done some things to lose my trust, and they're slowly building it back, but i'm not there. >> mr. munoz, same question. >> you know, flying on aircraft, i'll answer that question from a pilot's perspective. pilots don't have any reservation about flying on the aircraft safety is there. i trust boeing as well, but we don't know what's coming we don't know what the new ceo is going to do and answering that question is, time will tell not because of boeing and it's wonderful people and professionals, but because the leadership is still sort of in a mix there. and so ask us that later and we'll have a better answer >> i don't mean to embarrass you, but if they called, would you take the job as ceo? >> well, thank you i'll stay off that pattern for now. there's enough speculation going around, but listen, it's a great

1:29 pm

company. >> understand. thank you both appreciate your time today all right. we will hear from two airline ceos tomorrow. american airlines president robert isom will join "squawkbox" at 7:20 eastern. southwest's bob jordan joins "squawk on the street" at 9:30 a.m. you'll see both of them. don't miss them tomorrow on cnbc still ahead, ibm, caterpillar and meta getting ready to report. we have the key things to watch and how to position into the print. plus, ai in health care. i'll speak to the ceo of one company that is leveraging the technology to simplify and streamline, it says right here, the health care billing process. i want to see how they're going to do that they'll tell us how, ahead

1:33 pm

ukraine has started to use long-range missiles secretly provided by the u.s. to hit areas held by russia, according to a "new york times" report citing senior u.s. officials the army tactical missile systems were used to bombard russian airfields last week. joe biden had approved the delivery of the missiles early last month in a $300 million package, and the u.s. will provide more in the new aid package the president signed just today secretary of state antony blinken says the u.s. will be sending new military assistance to ukraine in a statement, the state department noted the $1 billion package would provide munitions and equipment for ukraine to use immediately on the battlefield the announcement comes after joe biden signed the national security supplemental package today. and more than a quarter of u.s. adults over 50 years old

1:34 pm

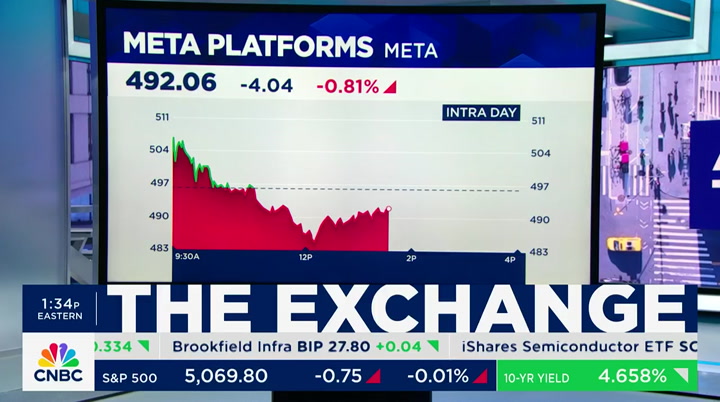

say they don't expect to ever be able to retire according to an aarp survey, for many, it's just a financial issue. they cited everyday expenses like housing cost, including rent and mortgage payments as the biggest reasons why they're unable to save tyler, one in five have nothing saved for retirement that's really scary proposition. >> depressing, shocking. meta shares nearly flat ahead of its earnings ahead of the bell today can the company deliver on ai and ads? we'll dig into that. and do not miss the 2024 cnbc stock draft featuring wwe superstar charlotte flair, nba champ kenny smith, and more. that's tomorrow at 2:00 p.m. eastern on "pow "pow "power plunch."

1:35 pm

at corient, wealth management begins and ends with you. we believe the more personal the solution, the more powerful the result. we treat your goals as our own. we never lose focus on the life you want to build. and our experienced advisors design custom built strategies to help you get there. it's time for a wealth management experience as sophisticated as you are. it's time for corient.

1:37 pm

welcome back to "the exchange," everybody another member of the mag seven set to report this afternoon you've heard the name before we have the action, the story, and the trade on meta platforms, that's one plus, caterpillar and ibm. let's start off with ibm the shares up nearly 33% in the past six months. steeple flagging the software growth there, red hat bookings and its consulting business as some of the key factors. you are a big blue believer,% sir. >> i am, tyler thanks for having me

1:38 pm

ibm's strength is the interconnectedness of their offerings. that's a big reason why customers are still sticking, and you have those inch up in there. so i like what ibm is doing. i think they perform, you know, somewhat well for execution part of it. but if you look at their balance sheet, it's somewhat strong. they have areas where they can grow, so i would be a buyer here >> been a long while since i looked at ibm and seen it up 46% over the last year caterpillar, up 60% over the past year. bank of america includes a potential rebound in china demand and lower copper prices and potential growth catalysts you like b of a and cat's balance sheet. >> i do like cat's balance sheet. they're in a position where we're at a high inflationary environment and they are still doing well if you look what's happening abroad, the infrastructure spending is still happening. that benefits caterpillar, and

1:39 pm

with the shares are doing well i think we're going to fair economically better than expected, better than even i expected so i think the shares will do well >> let's move on to meta that's one that a lot of people had their eye on for this afternoon. the second best performing mag name, with shares up more than 130% over the past year. ad revenue growth and expense management, those are two things in focus what are you looking for this afternoon, delan snorvegs >> continued growth on the top and bottom line from meta. the stock has performed and have really outshined for the mag seven. i think there's more room to growth they've done a good job in changing their advertising tool. k we have seen the advertising growth come back that's a long-term shot that's still showing a loss there on

1:40 pm

their reports for that but overall, they have an opportunity here with reels. they have an opportunity with threads. i think they're building such an ecosystem that it's only going to benefit meta. i would be a buyer here. >> thank you very much always good to see you let's move on. a key metric investors will be watching for is the company's ad business, as digital ad sales contributed 97% of meta's revenue. so will this growth continue into the first quarter let's bring in advertising expert mountain ceo mark douglas. mark, good to have you with us >> thanks. >> good. we usually see you on the stock draft, right >> well, it's hard to compete with nvidia this year and netflix, as well >> you can't beat nvidia this year let's talk about incredible growth at meta in the ad business year over year through the last quarter

1:41 pm

what are you looking for this quarter, and can they keep it up >> i think they are going to keep it up so meta, you know, i think what last year showed is when they get very focused, they have a lot of leverage in the business. a lot of leverage comes from the advertising tech companily if they can drive more visit and revenue to a brand, that brand's going to step up to the plate and spend those dollars. so that's what happened. i think that will continue, and also i think q1, at least in mountain's business, is off to a nice start i think the same is happening with meta and google and others. so it's going to be an overall great quarter. i don't see anything that will slow that down >> their ad revenue, 25% year on year, total impressions and price per ad, that has been delivering very well so on all of the advertising metrics, this thing is hot as they come. >> yeah. you know, the thing about meta

1:42 pm

is all of the ads stem from meta if you go to tiktok, pintrest, they are staffed by people that have meta. they're very good at it. >> let's talk about today's news, and that is the potential that tiktok will be banned in the united states. i don't know whether that will happen there's a lot that needs to happen between now and that point. there will be legal challenges, potentially constitutional challenges but if it were to happen, would meta be the principal beneficiary? >> i think they would be one of the big beneficiaries, but it won't occur overnight. the way performance advertisers think, it's like managing a portfolio of marketing dollars and just like in the stock market, sometimes you just -- you know what, i'm just going to sit it out so it's not like those dollars are going to instantly shift to dollar if that were to occur but they and others, amazon,

1:43 pm

others, hopefully my company would all benefit over time. but it wouldn't be like, you know, quarter over quarter, just like a massive shift to any of those companies, including meta. >> mark, always great to see you. thank you for being with us today. >> thank you >> we appreciate it. mark douglas of mountain still ahead, speaking of tiktok, we'll get what's next for its key algorim.th "the exchange" will be right back

1:44 pm

1:45 pm

1:46 pm

joe biden wasted no time, he signed the bill that bans tiktok unless the chinese parent company bytedance sells it within a year, but a sale would figure out how to break off a key technology that breaks off the algorithm. deidre bosa has more on that >> that algorithm is all that matters. tiktok's algorithm is a black box, but it's also the most important thing about the app. now, without it, any financial buyer is buying something with a lot less value many have tried to get at the source code, and while some have revealed its strategies, broad

1:47 pm

stra strategy, none have been successful at uncovering the actual detailed workings the company, like many tech companies, keep this algorithm process confidential what we do know is that it uses a combination of machine learning techniques and user behavior analysis to optimize delivery the new york times in 2021 got ahead of an internal document called tiktok algo 101 that outlined four main goals user value, long-termer user value, creator value and platform value but tiktok, which did confirm the authenticity, said it was written to explain how the algorithm works. so in other words, no source code and another big part how tiktok has remained on top, and you can see here, continues to keep users engaged better than copy cat apps like youtube and instagram. >> interesting so it's the algorithm that -- who owns that, bytedance opens

1:48 pm

that >> bingo >> would a buyer of tiktok gain that or not? >> unlikely that beijing is just going to hand it over. to the parent bytedance developed that algorithm in a very different internet land scape that exists in china it's unlikely that beijing is going to let go that -- of that. some folks think that's a laughable concept. mark zuckerberg has been trying to re-create the tiktok algorithm through reels, but he hasn't been able to get the same kind of engagement that tiktok has. and look at snap, it's difficult for them, even though they know this is such an effective tool maybe the only tool that matters in keeping folks on your platform >> so reverse sbengineering this

1:49 pm

algorithm is a nonstarter? >> a lot of people in tech think that's a tall task and nearly impossible the ideal that zuckerberg has problems hired thousands of data scientists to do that and hasn't been able to create that >> dei, thank you very much. coming up, analysis by kff of health care.gov revealed on average insurers are denied almost 20% of claims we'll talk to the ceo of a tech company leveraging patients from that that's next.

1:50 pm

at corient, wealth management begins and ends with you. we believe the more personal the solution, the more powerful the result. we treat your goals as our own. we never lose focus on the life you want to build. and our experienced advisors design custom built strategies to help you get there. it's time for a wealth management experience as sophisticated as you are. it's time for corient.

1:52 pm

you're probably not easily persuaded to switch mobile providers for your business. but what if we told you it's possible that comcast business mobile can save you up to 75% a year on your wireless bill versus the big three carriers? you can get two unlimited lines for just $30 each a month. all on the most reliable 5g mobile network—nationwide. wireless that works for you. for a limited time, ask how to save up to $830 off an eligible 5g phone when you switch to comcast business mobile. don't wait! call, click or visit an xfinity store today. welcome back. shares of humana falling despite strong earnings after they pulled the guidance for 2025. citing medicare price hikes, they had previously warned increasing medical costs

1:53 pm

would impact results this year and beyond. but, on a call with analysts, humana said costs were not running ahead of projections. joining us to discuss that and how his company is lowering costs for patients using ai is the ceo of anomaly. welcome. >> thank you for having me. >> let's talk about anomaly, an area i am fascinated by because i am vexxed when i try to understand benefits for my carrier. i am living it right now in a personal way. can a.i. help me understand what i am being charged, why i am being denied or claims are being kicked back to me? on the flipside, will the

1:54 pm

insurers use artificial intelligence to stay one step ahead of dummies like me? >> i am sorry you are having these experiences. all my best to you. you think it would be that simple, but it is not. the short answer is yes, ai can help. it starts with understanding and driving transparency into what is covered, when and why, we of all purchased health plans and click on more information and got more pages but less information. the fundamental thing we found, there were 540 million different combinations of codes that your provider needs to bill appropriately to get you paid your explanations on point. that is a computer challenge and not a personal challenge. >> how does ai alleviate or ameliorate those problems? and i

1:55 pm

come as a customer, or the insurance person in my doctor's office going to speak to an artificial intelligence source to explain what they need but will that source understand it? >> the short answer is, we operate behind the scenes. what we do with artificial intelligence is we take in all of the data your provider is sending out and all the data your insurance company is sending back to construct transparently what should transpire with that claim, so you, as the patient, get the care you need and a clear explanation of what should happen ideally, not get a bill in the mail if all goes her properly. to your question, in a lot of ways your doctors office can tackle it, but we are trying to remove the work in asking ai and giving them the right information in advance. >> ensures are using ai, too, i

1:56 pm

am sure, in ways that may obfuscate or may hasten denials, how -- how will you stay ahead of what they do, or will you partner with them? >> sure. in the future, i hope to partner with them and providers and payers can go together on transparency using these technologies. right now, providers are bringing on the ai, they are fighting each other. that is not a good future for anybody. both sides are trying to reduce costs, you see that in the earnings for humana, and right now, it looks like utilizing ai to remove the administrative costs on their side. in the future, they should come together. >> forgive me for ejecting my personal perspective, but it seems to me, sometimes, in my

1:57 pm

experience, insurance companies make the system overly competent and may reject claims for whatever reason, on the hope that i will do one a lot of people do say, i will pay it anyway, am i right or wrong? >> i cannot speak to the motivation but i can't speak to the complication of getting it done, for an individual to fight humana is a daunting task. the different dates you may put up like a prior authorization, they are infrequently fought. less than 10% of the time. they are frequently won, more than 80% of the time. ripe for change. >> anomaly ceo, thank you, we will have you back again. that does it for the exchange, power lunch is next with contessa brewer.

1:58 pm

nal, you can skp the counter... and choose any car in the aisle... even manage your rental right from the app. so you can give some quality time to a quality cause. swing by to see one more customer... [audience cheering] and really get down to business. go national. go like a pro. [alarm beeping] amelia, turn off alarm. amelia, weather. 70 degrees and sunny today. amelia, unlock the door. i'm afraid i can't do that, jen. why not? did you forget something? my protein shake. the future isn't scary, not investing in it is. you're so dramatic amelia. bye jen. 100 innovative companies, one etf. before investing, carefully read and consider fund investment objectives, risks, charges expenses and more prospectus at invesco.com.

2:00 pm

good afternoon. welcome to power lunch. glad you could join us. the big story is earnings, major companies reporting results and we have reporters breaking down the results and reviewing the ones coming up. we will have three names. we are just 24 hours away from one of our favorite days of the year, the stock

222 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Open Library

Open Library American Libraries

American Libraries TV News

TV News Understanding 9/11

Understanding 9/11